CIBC Mobile Banking App Review 2025: Game-Changer or Just Hype?

In the dynamic landscape of Canadian finance, the Canadian Imperial Bank of Commerce(CIBC) stands as a venerable institution, a cornerstone of the nation’s banking infrastructure. As we navigate the digital currents of 2025, the criticality of a robust and intuitive mobile banking application cannot be overstated. These digital conduits have transcended mere convenience, evolving into indispensable tools for financial management, transactional fluidity, and proactive fiscal oversight.

This comprehensive review endeavors to dissect the CIBC Mobile Banking App, scrutinizing its functionalities, user experience, and overall efficacy to ascertain whether it truly represents a paradigm shift in digital banking or merely an incremental enhancement amidst a competitive financial technology (FinTech) milieu.

1. First Impressions & User Interface

The initial engagement with any digital financial platform sets the tone for its adoption and sustained utility. The CIBC Mobile Banking App, available on both the Google Play Store and Apple App Store, offers a streamlined download and setup process, a critical factor in user acquisition and retention. Anecdotal evidence and preliminary observations suggest a relatively frictionless onboarding experience, aligning with contemporary expectations for digital applications.

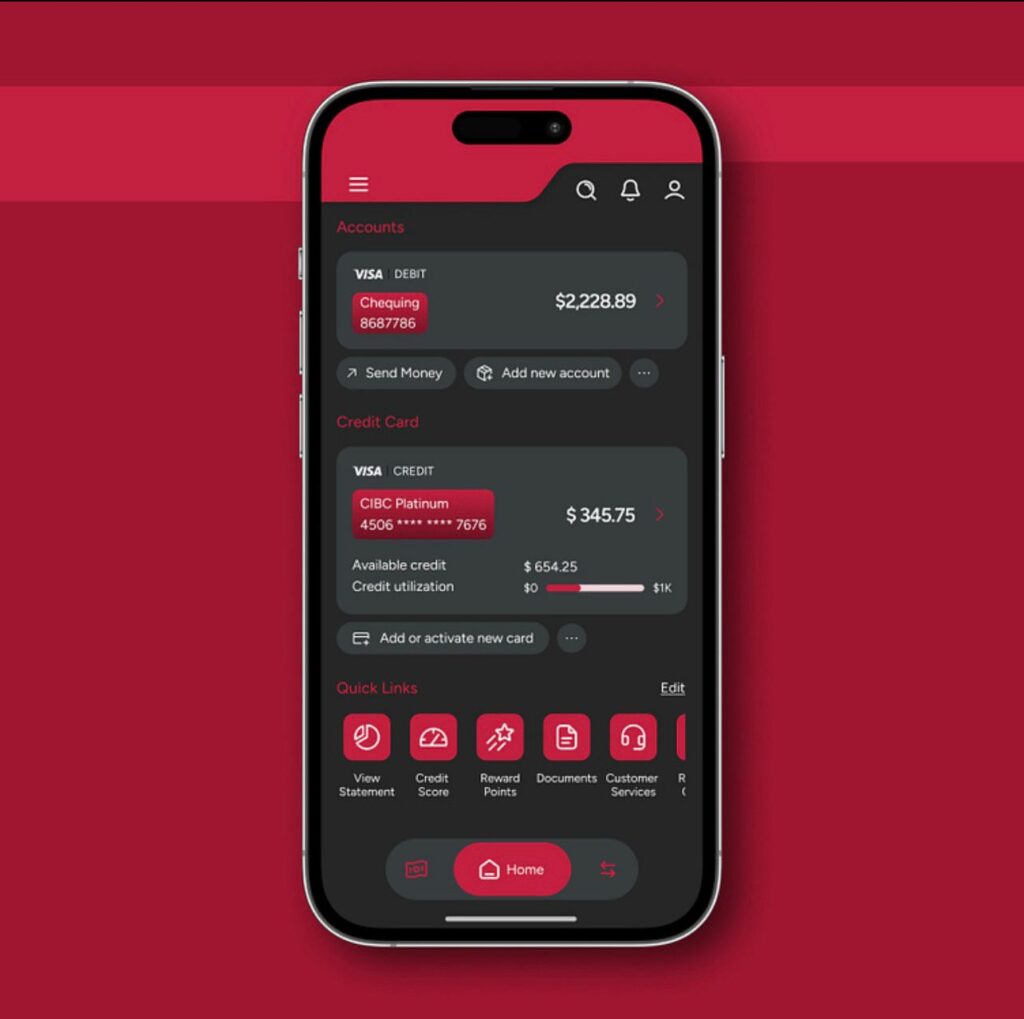

Upon launch, the app presents a clean, modern aesthetic, characterized by an intuitive layout and a judicious use of visual elements. The design philosophy appears to prioritize clarity and functional accessibility, eschewing superfluous ornamentation in favor of a direct and purposeful user journey. Navigation within the application is largely self-evident, with key functionalities readily discoverable through a well-structured menu system and logical information architecture. This design approach contributes significantly to the app’s ease of use, enabling users to swiftly access account information, initiate transactions, and manage their financial portfolios with minimal cognitive friction.

Crucially, the app demonstrates a commendable commitment to accessibility, a vital consideration in fostering inclusive financial services. While specific details regarding compliance with accessibility standards (e.g., WCAG) would necessitate a deeper technical audit, the general design principles, such as clear typography, sufficient color contrast, and logical flow, suggest an earnest attempt to cater to a diverse user base, including individuals with varying degrees of digital literacy and those requiring assistive technologies.

⸻

2. Key Features Breakdown

The true utility of a mobile banking application resides in the breadth and depth of its feature set. The CIBC Mobile Banking App offers a comprehensive suite of functionalities designed to cater to the multifaceted financial needs of its clientele. Below is a detailed examination of its pivotal features:

Account Overview & Balances

At the core of any banking application is the ability to provide a clear and concise overview of one’s financial standing. The CIBC app excels in this regard, presenting users with an immediate snapshot of all linked accounts, including chequing, savings, credit cards, and investment portfolios. Balances are prominently displayed, and the interface allows for quick drill-downs into transactional history, offering a granular view of financial inflows and outflows. This intuitive presentation empowers users with real-time financial intelligence, facilitating informed decision-making.

Mobile Cheque Deposit

Revolutionizing the traditional banking paradigm, the mobile cheque deposit feature, often referred to as CIBC e Deposit, allows users to deposit cheques simply by capturing an image of the front and back of the cheque using their smartphone camera. This functionality significantly enhances convenience, eliminating the need for physical branch visits or ATM interactions. The process is typically secure, with encrypted transmission and immediate confirmation of deposit, though funds availability remains subject to standard banking hold policies.

E-Transfers & Bill Payments

Interac e-Transfers, a ubiquitous payment method in Canada, are seamlessly integrated into the CIBC app. Users can send and receive funds with remarkable ease, requiring only the recipient’s email address or mobile number. The app also facilitates efficient bill payments, allowing users to add new payees, manage existing ones, and schedule one-time or recurring payments. This feature underscores the app’s commitment to streamlining everyday financial obligations.

Credit Score Access via the App

A notable differentiator for the CIBC app is the provision of free Equifax credit score access directly within the application. This feature empowers users to monitor their credit health without incurring additional costs or impacting their score through hard inquiries. Regular access to credit scores fosters financial literacy and enables users to proactively manage their credit profiles, a critical component of long-term financial well-being.

Push Notifications and Alerts

The app leverages push notifications and customizable alerts to keep users abreast of their account activity. These real-time notifications can be configured for various events, including transaction alerts, low balance warnings, bill payment reminders, and security alerts. This proactive communication mechanism enhances financial security and provides users with timely information, enabling swift action in response to any unusual or critical account activity.

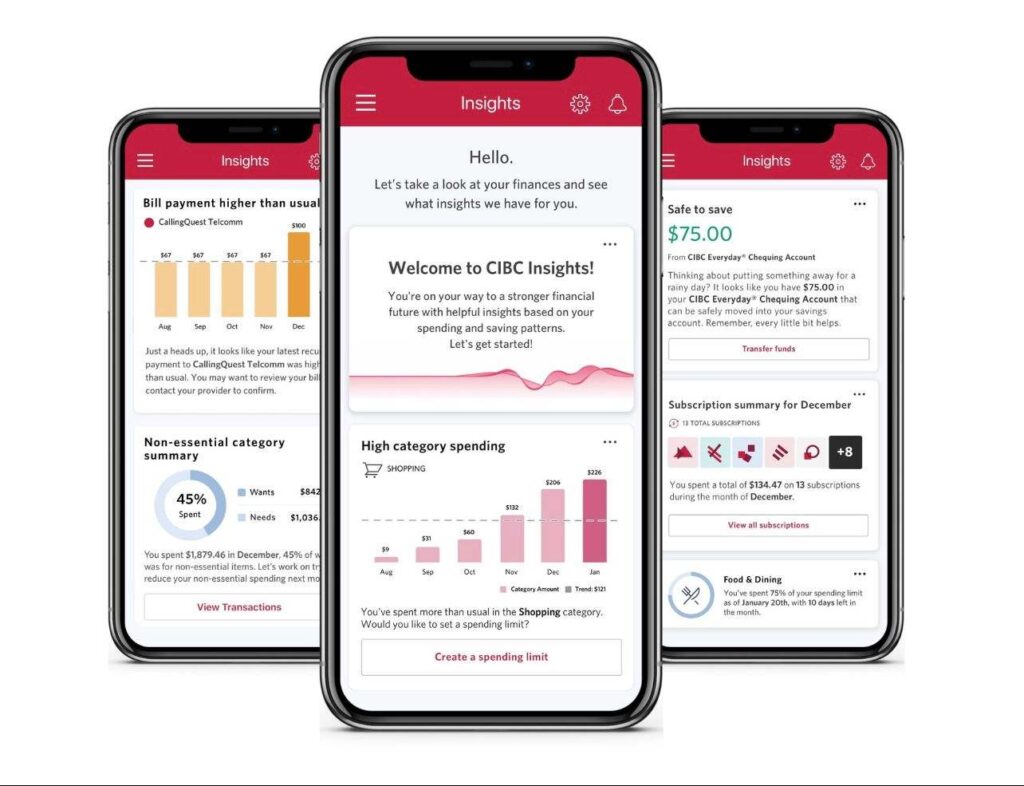

AI-Powered Financial Insights

While the CIBC app may not explicitly market a dedicated ‘AI-Powered Financial Insights’ module as a standalone feature, elements of intelligent financial guidance are subtly integrated. For instance, the CIBC Smart Planner, accessible through the app, offers tailored tips based on spending habits and credit activity. This feature, while not a full-fledged AI financial advisor, represents an incipient step towards personalized financial intelligence, providing users with actionable insights to manage their daily spending and cultivate healthier financial habits.

⸻

3. What’s New in 2025?

The year 2025 has witnessed a continued evolution in the CIBC Mobile Banking App, reflecting the bank’s commitment to enhancing the digital banking experience. While specific groundbreaking, never-before-seen features are often under wraps until official announcements, a discernible trend towards refinement and user-centric improvements is evident. Recent updates, as indicated by app store release notes and official CIBC communications, primarily focus on bolstering reliability, optimizing performance, and refining the user interface for a more seamless interaction.

One notable enhancement is the introduction of a redesigned bottom navigation, which aims to place frequently accessed features within easier reach, thereby streamlining the user journey. This seemingly minor adjustment can significantly impact daily usability, reducing the number of taps required to perform common banking tasks. Furthermore, the emphasis on ‘Smart Search’ functionality suggests an ongoing effort to improve discoverability of features and information within the app, catering to users who prefer a direct search approach over hierarchical navigation.

While explicit announcements regarding deep integration with third-party fintech tools (e.g., budgeting apps, cryptocurrency platforms) are not prominently featured, the general trajectory of digital banking suggests an increasing openness to such interoperability. CIBC’s continued focus on personalized insights through tools like Smart Planner hints at a future where the app could leverage more sophisticated AI and data analytics to offer proactive financial advice and seamless connections to a broader ecosystem of financial services. The consistent updates, even if primarily focused on performance and minor UI tweaks, underscore a continuous development cycle aimed at maintaining the app’s competitive edge and responsiveness to evolving user expectations.

⸻

4. Performance & Security

In the realm of digital banking, performance and security are not merely features but foundational pillars upon which user trust and adoption are built. The CIBC Mobile Banking App demonstrates a commendable commitment to both, striving to deliver a reliable and secure financial environment.

App Speed and Reliability

User experience is inextricably linked to application performance. The CIBC app generally exhibits robust speed and reliability, with swift loading times and minimal reported crashes. This operational fluidity is crucial for maintaining user engagement, particularly during critical financial transactions. While isolated instances of technical glitches or slower performance may occur, as is common with any complex software, the overall consensus from user feedback and industry assessments points to a consistently stable platform. The continuous updates, as noted in app store release logs, often include bug fixes and performance enhancements, indicating a proactive approach to maintaining optimal operational integrity.

Biometric Login (Face ID, Fingerprint)

Embracing contemporary security paradigms, the CIBC app offers biometric authentication methods, including Face ID and fingerprint recognition. This feature significantly enhances both security and convenience, allowing users to access their accounts swiftly and securely without the need for manual password entry. Biometric authentication leverages unique physiological characteristics, providing a robust layer of protection against unauthorized access, thereby mitigating risks associated with traditional password-based vulnerabilities.

Two-Factor Authentication

Beyond biometric logins, the CIBC app incorporates two-factor authentication (2FA) as a critical security measure. This multi-layered approach requires users to provide two distinct forms of identification before granting access to sensitive account information or authorizing transactions. Typically, this involves a combination of something the user knows (e.g., password) and something the user has (e.g., a code sent to a registered mobile device). 2FA significantly fortifies the app’s security posture, providing an additional barrier against sophisticated cyber threats and unauthorized account compromise.

Real-time Fraud Alerts and Data Encryption

CIBC employs advanced security protocols to safeguard user data and financial transactions. Real-time fraud alerts serve as an early warning system, notifying users of suspicious activities or unusual spending patterns, enabling prompt action to mitigate potential fraudulent events. Furthermore, all data transmitted through the app is subject to stringent encryption standards, ensuring that sensitive financial information remains confidential and protected from interception by malicious actors. The bank’s commitment to data privacy and security is further underscored by its adherence to industry best practices and regulatory compliance, providing users with a secure digital banking ecosystem.

⸻

5. Pros and Cons

An objective assessment of the CIBC Mobile Banking App necessitates a balanced examination of its strengths and weaknesses, particularly when benchmarked against its primary Canadian counterparts: RBC, TD, and Scotiabank. This comparative analysis illuminates the app’s competitive positioning and areas ripe for enhancement.

✅ Pros

- Clean, modern, and intuitive user interface (UI)

- Fast performance with minimal bugs or crashes

- Features like mobile cheque deposit, e-Transfers, and bill pay

- Free access to Equifax credit score

- Strong security with Face ID, fingerprint login, and 2FA

- Good accessibility design for all user levels

⚠️ Cons

- Occasional login persistence and form autofill bugs

- Lacks deeper AI-driven financial tools like RBC’s NOMI

- Minor compatibility issues with older devices

- Some users dislike recent UI layout changes

- Limited investment management tools within the app

Pros: What Stands Out

User Interface (UI) and Experience (UX): The CIBC app consistently garners praise for its clean, intuitive, and modern UI. Its streamlined navigation and logical layout contribute to a superior user experience, often cited as more fluid and less cluttered than some competitor offerings. This focus on design simplicity ensures that even complex financial tasks can be executed with relative ease, fostering a sense of control and efficiency for the user.

Feature Set: The app boasts a robust array of features that cater to the daily banking needs of most Canadians. The seamless integration of mobile cheque deposit (CIBC eDeposit), Interac e-Transfers, and comprehensive bill payment functionalities are particularly strong points. The inclusion of a free Equifax credit score directly within the app is a significant value-add, providing users with a convenient and cost-effective means of monitoring their credit health, a feature not universally offered by all competitors.

Performance and Reliability: The CIBC app generally demonstrates commendable speed and stability. Users frequently report quick loading times and minimal instances of crashes or significant performance degradation. This reliability is paramount for financial applications, where interruptions can lead to frustration and distrust. The consistent updates aimed at performance optimization further solidify its standing in this regard.

Accessibility: While not always explicitly highlighted, the app’s design principles appear to incorporate accessibility considerations, making it a more inclusive platform for a broader spectrum of users, including those with disabilities. This commitment to barrier-free banking is a critical, albeit often understated, advantage.

Cons: What Needs Improvement

Glitches and Inconsistencies: Despite overall reliability, some user feedback indicates occasional glitches, particularly concerning login persistence for certain transactions (e.g., TFSA contributions) or form autofill issues. While not widespread, these intermittent technical anomalies can disrupt the user flow and detract from an otherwise smooth experience. This suggests a need for continuous quality assurance and bug resolution to eliminate these friction points.

Missing Tools/Features (Perceived): While comprehensive, the app may be perceived as lacking certain advanced functionalities or deeper integrations that some power users or specific demographics might desire. For instance, while it offers basic financial insights, a more robust, AI-driven personal financial management (PFM) suite that proactively identifies spending patterns, suggests budgeting strategies, or offers predictive financial advice could elevate its utility. Some users might also seek more granular control over investment portfolios directly within the app, beyond basic overview functions.

Compatibility Issues (Minor): Isolated reports of compatibility issues with specific older device models or operating system versions occasionally surface. Ensuring broad compatibility across the rapidly evolving mobile device ecosystem remains a continuous challenge for all banking apps.

Comparison with RBC, TD, and Scotiabank Apps

RBC Mobile: RBC’s app is often lauded for its innovative features like NOMI, an AI-powered financial insights tool that proactively helps users save and manage money. While CIBC has Smart Planner, NOMI is generally considered more advanced in its AI capabilities. RBC’s app also maintains a strong focus on user experience and security, making it a formidable competitor.

TD Canada: TD’s mobile app consistently ranks high in customer satisfaction, often praised for its comprehensive features, including robust investment management tools and a userfriendly interface. TD has also invested heavily in personalized insights and a seamless integration of everyday banking with investment services, offering a holistic financial management experience. However, some users have noted a lack of transaction alerts, a feature that CIBC’s app provides.

Scotiabank Mobile Banking: Scotiabank’s app, while functional, has received mixed reviews, with some users reporting performance issues and a less intuitive interface compared to its peers. Recent updates have aimed to address these concerns, focusing on improved stability and faster loading times. Scotiabank’s app offers core banking functionalities but may not always match the advanced features or polished user experience of CIBC, RBC, or TD.

⸻

6. Real User Feedback

Beyond the technical specifications and feature lists, the true litmus test for any mobile banking application lies in the experiences of its end-users. A comprehensive review necessitates an examination of feedback gleaned from popular app distribution platforms, namely the App Store and Google Play, alongside anecdotal insights from various user demographics.

Reviews from App Store/Google Play

The CIBC Mobile Banking App generally maintains a respectable rating across both major app stores, typically hovering around 3.9 to 4.3 out of 5 stars. This aggregate score, while indicative of overall satisfaction, masks a spectrum of individual experiences. A deeper dive into the voluminous user comments reveals recurring themes of both commendation and critique.

Common Praise and Frequent Complaints

Common Praise:

- Responsiveness and Speed: A significant portion of positive reviews extols the app’s swift performance, noting quick loading times and seamless navigation. Users appreciate the efficiency with which they can execute transactions and access information, often contrasting it favorably with less optimized banking applications.

- Intuitive Interface: The clean and uncluttered design, coupled with logical information architecture, frequently receives accolades. Many users find the app exceptionally easy to use, even for those less technologically inclined, highlighting its user-friendly nature.

- Comprehensive Functionality: The breadth of features, particularly mobile cheque deposit, Interac e-Transfers, and bill payment capabilities, is consistently praised. The ability to perform a wide array of banking tasks without resorting to a desktop or physical branch is a major draw.

- Credit Score Access: The inclusion of a free Equifax credit score directly within the app is a highly valued feature, empowering users with convenient access to their credit health.

Frequent Complaints:

- Login Persistence Issues: A recurring frustration for some users involves the app’s requirement to re-authenticate, often with a full card number and password, even when already signed in, particularly for specific transactions like TFSA contributions. This disrupts workflow and creates unnecessary friction.

- New Layout Discontent: While the recent UI redesign aims for improvement, a segment of long-time users expresses dissatisfaction with the new layout, perceiving it as less efficient or more cluttered than previous versions. Comments suggest a preference for the older interface, citing issues with space utilization and the grouping of account totals.

- Occasional Bugs/Glitches: Despite overall stability, isolated reports of bugs, such as application errors during transaction processing or or issues with form autofill, surface periodically. These intermittent technical hiccups, while not widespread, can significantly impact individual user experiences.

- Feature Parity with Desktop: Some users lament a perceived lack of full feature parity with the desktop online banking platform, suggesting that certain advanced functionalities or specific transactional flows are either absent or less optimized within the mobile app.

Feedback from Seniors and Tech Novices

Feedback from seniors and tech novices is particularly insightful, as it gauges the app’s true accessibility and ease of adoption for a broader demographic. Generally, the app’s intuitive design and straightforward navigation are appreciated by this group, enabling them to manage their finances with a degree of independence. The clear visual cues and simplified processes contribute to a less intimidating banking experience. However, some tech novices may still encounter challenges with more advanced features or troubleshooting minor technical issues, underscoring the importance of robust customer support channels and clear in-app guidance. The occasional login persistence issues, for instance, can be particularly frustrating for users who prefer a simpler, more consistent authentication process.

⸻

7. Who Is It Best For?

The CIBC Mobile Banking App, with its distinct blend of features and user experience, caters to a diverse spectrum of financial consumers. Identifying its ideal user base is crucial for prospective users seeking a digital banking solution aligned with their specific needs and preferences.

Casual Users vs. Heavy Financial Planners

For the casual user, who primarily engages in routine banking activities such as checking balances, depositing cheques, paying bills, and initiating Interac e-Transfers, the CIBC app is an exceptionally well-suited tool. Its intuitive interface, streamlined navigation, and reliable performance ensure that these everyday financial tasks are executed with minimal effort and maximum efficiency. The app’s simplicity and ease of use make it an ideal choice for individuals seeking a straightforward and dependable mobile banking experience without the need for highly complex financial management functionalities.

Conversely, heavy financial planners or those with intricate investment portfolios might find the app’s current iteration somewhat less comprehensive than dedicated financial planning software or brokerage platforms. While it provides a clear overview of accounts and offers basic insights through Smart Planner, it may not fully satisfy the demands of users requiring advanced analytical tools, sophisticated budgeting features, or direct, granular control over diverse investment vehicles. These users might still rely on a combination of the mobile app for transactional convenience and the desktop platform or specialized third-party applications for deeper financial strategizing.

Small Business Owners

For small business owners, the CIBC Mobile Banking App offers a foundational set of tools that can facilitate day-to-day financial operations. Features such as mobile cheque deposit, efficient bill payments, and real-time account monitoring are invaluable for managing business cash flow on the go. However, for more specialized business banking needs, such as payroll management, complex invoicing, or integration with accounting software, business owners may need to leverage CIBC’s dedicated business banking platforms or third-party solutions. The app serves as a competent companion for basic transactional needs but may not be a standalone solution for comprehensive business financial management.

Students or Newcomers to Canada

The CIBC Mobile Banking App is particularly advantageous for students and newcomers to Canada. For students, the app’s ease of use, coupled with essential features like Interac eTransfers for managing expenses and free credit score access for building financial literacy, makes it an accessible entry point into Canadian banking. Newcomers to Canada, often navigating a new financial ecosystem, will find the app’s straightforward onboarding process and clear interface highly beneficial. The availability of the app in both English and French further enhances its utility for a diverse population. The ability to apply for accounts and credit cards directly through the app also simplifies the initial steps of establishing financial roots in the country.

In summary, the CIBC Mobile Banking App is an excellent choice for individuals prioritizing ease of use, core banking functionalities, and reliable performance for everyday financial management. It serves as a strong digital anchor for casual users, students, and newcomers, while more sophisticated financial needs might necessitate supplementary tools or platforms.

⸻

Conclusion

In the rapidly evolving landscape of digital finance, the CIBC Mobile Banking App in 2025 stands as a robust and highly competent offering within the Canadian banking sector. Our comprehensive review, encompassing its features, user experience, performance, security, and real-world user feedback, leads to a nuanced conclusion regarding its status as a potential “game-changer.”

Summary of Key Findings

The app excels in providing a clean, intuitive, and modern user interface, making everyday banking tasks remarkably straightforward. Its core functionalities, including mobile cheque deposit, Interac e-Transfers, and bill payments, are seamlessly integrated and highly efficient. The provision of free Equifax credit score access is a significant value proposition, empowering users with crucial financial intelligence. Furthermore, the app demonstrates a strong commitment to security, employing biometric logins, two-factor authentication, and real-time fraud alerts, thereby fostering a secure digital banking environment. Performance is generally swift and reliable, with consistent updates aimed at enhancing stability and user experience.

However, the app is not without its areas for improvement. Some users report intermittent login persistence issues for specific transactions, and a segment of the user base expresses discontent with recent UI changes, preferring older layouts. While offering basic financial insights, it currently lacks the deep, AI-driven personalized financial management tools that some competitors are beginning to champion, which could elevate its utility for more sophisticated financial planners.

Is it a true game-changer or overhyped?

Based on our analysis, the CIBC Mobile Banking App in 2025 is not a revolutionary gamechanger in the vein of disruptive FinTech innovations. Instead, it represents a highly refined and exceptionally well-executed iteration of contemporary mobile banking. It embodies the best practices of the industry, delivering a secure, efficient, and user-friendly platform that meets and often exceeds the expectations for a major Canadian bank. Its strengths lie in its reliability, comprehensive core features, and a user experience that prioritizes simplicity and accessibility.

While it may not introduce radical new paradigms, its continuous evolution, particularly in areas like personalized insights and UI refinement, positions it as a strong contender and a leader in customer satisfaction within the Canadian market. It is a testament to incremental innovation, where consistent improvement and a focus on core user needs drive its success.

⸻

Final Rating: ★★★★☆

The CIBC Mobile Banking App earns a solid 4 out of 5 stars. It is an exemplary tool for everyday banking, offering a secure and efficient platform for managing personal finances. The minor deductions are attributed to occasional technical quirks and the potential for deeper integration of advanced AI-driven financial insights.

Tried the CIBC app? Drop your experience in the comments!

⸻

FAQ

Is CIBC Mobile Banking free to use?

Yes, the CIBC Mobile Banking App is free to download and use. However, standard account fees and transaction charges associated with your CIBC accounts may still apply. Data charges from your mobile service provider may also apply when using the app.

Can I deposit cheques with the app?

Absolutely. The CIBC Mobile Banking App features CIBC eDeposit, which allows you to deposit cheques by simply taking a picture of the front and back of the cheque with your smartphone camera. This feature is secure and convenient.

Does it support multiple accounts or joint accounts?

Yes, the CIBC Mobile Banking App allows you to view and manage all your linked CIBC accounts, including chequing, savings, credit cards, and investment accounts, in one place.

If you have joint accounts, these will also be accessible through the app, provided you are an authorized user.

Is CIBC’s mobile app safe from fraud or hacking?

CIBC employs robust security measures to protect your financial information. This includes biometric login options (Face ID, fingerprint), two-factor authentication, real-time fraud alerts, and advanced data encryption for all transmissions. CIBC is committed to protecting your privacy and security, adhering to industry best practices and regulatory standards.

Can I use it while traveling internationally?

Yes, you can use the CIBC Mobile Banking App while traveling internationally, provided you have an internet connection (Wi-Fi or mobile data). The app also includes a ‘Travel Tools’ feature with a currency converter, helpful tips, and emergency numbers, which can be particularly useful when abroad.