“Neo Financial App Review 2025: Is It Legit, Safe, and Worth Using in Canada?”

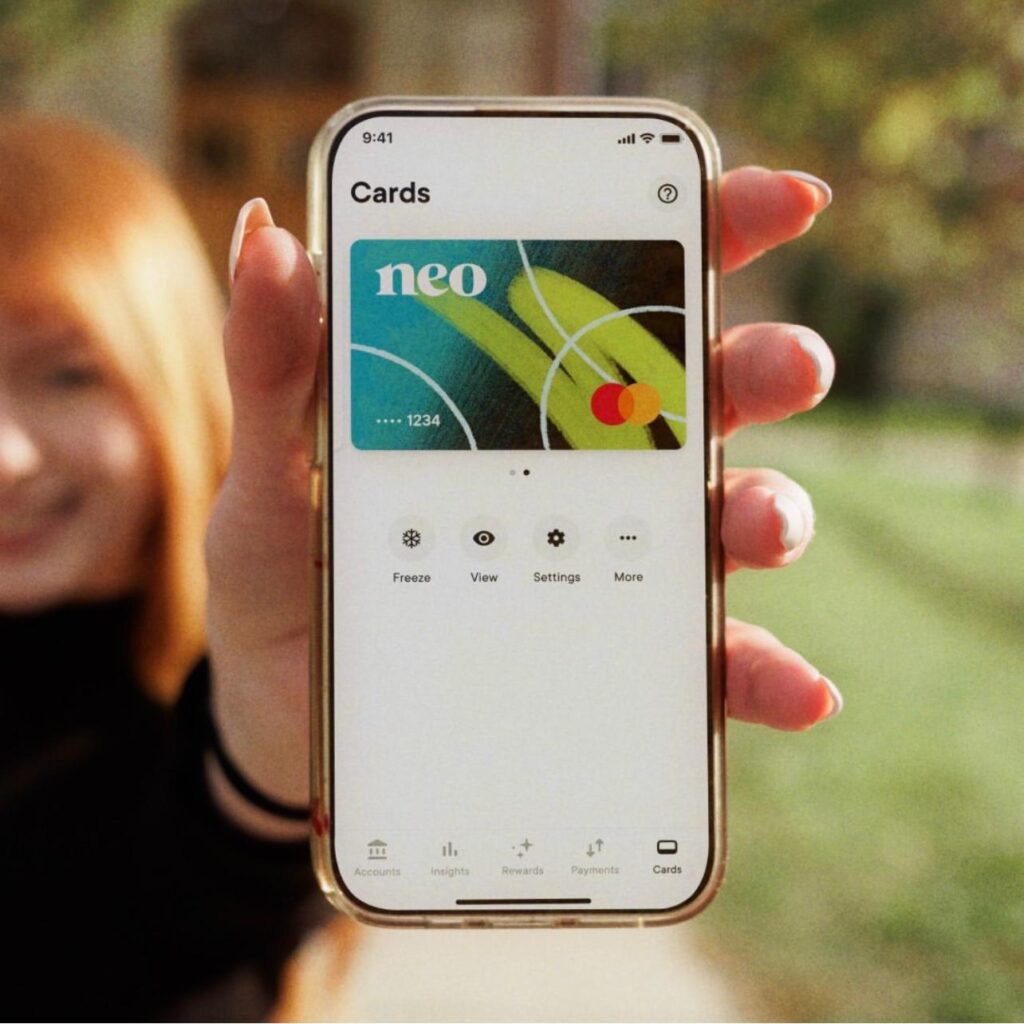

📸 Image credit: @neofinancial on Instagram

The Canadian financial landscape has undergone a significant transformation in recent years, marked by the rise of digital banking and the emergence of powerful disruptors. Among these, the Neo Financial App has garnered considerable attention, positioning itself as a modern solution for spending, saving, and earning in Canada.

This review explores the core aspects of the Neo Financial App, addressing critical questions that potential users may have. We will explore its legitimacy, assess its safety measures, and evaluate its real-world usability in the Canadian market. By examining its features, partnerships, and overall value proposition, this article seeks to provide a clear and objective perspective on whether Neo Financial is a worthwhile financial tool for Canadians in 2025.

⸻

- What Is the Neo Financial App?

Neo Financial is a Canadian financial technology (fintech) company headquartered in Calgary, Alberta, that aims to challenge conventional banking with a technology-first approach. Founded in 2019 by the co-founders of SkipTheDishes, Andrew Chau, Jeff Adamson, and Kris Read, Neo Financial has rapidly grown to become a prominent player in the Canadian financial sector.

At its core, Neo operates on a neobank model, which distinguishes it significantly from traditional brick-and-mortar banks. Unlike conventional banks with extensive physical branch networks, neobanks like Neo Financial are entirely digital, offering their services primarily through a mobile application and online platform. This digital-first approach allows Neo to operate with lower overheads, often translating into more competitive rates, fewer fees, and innovative features for its users.

Through its intuitive mobile application, Neo Financial offers a suite of financial products and services designed to streamline everyday banking for Canadians. These include:

• Spending Accounts: The Neo Money™ account functions as an everyday spending account with no monthly fees, no minimum balances, and free everyday transactions.

• Savings Accounts: Neo provides high-interest savings accounts that often offer competitive interest rates compared to traditional banks, allowing users to grow their money more effectively.

• Cashback Rewards: A major draw of Neo Financial is its robust cashback program. Users earn instant cashback on purchases made through their Neo cards at a vast network of partner retailers across Canada.

• Credit Products: Neo also offers credit card solutions, including the Neo Mastercard, which provides cashback rewards and other benefits.

By integrating these services within a single, user-friendly app, Neo Financial aims to provide a modern banking experience that is both convenient and rewarding.

⸻

📸 Image credit: @neofinancial on Instagram

- Is Neo Financial Legit in Canada?

One of the top concerns for new users is whether the institution is legitimate and regulated. For Neo Financial, the answer is yes — primarily due to its strategic partnerships and adherence to Canadian financial regulations.

Neo Financial operates as a fintech company. While it is not a chartered bank, it partners with regulated financial institutions to offer its banking products. Neo Money accounts are provided by Concentra Bank, a Canadian chartered bank and a member of the Canada Deposit Insurance Corporation (CDIC). That means eligible deposits are protected by CDIC up to $100,000 per insured category, per depositor — offering a significant layer of security for users.

Neo Financial’s legitimacy is also supported by:

• Its rapid user growth

• Strategic partnerships with major retailers like Hudson’s Bay and Petro-Canada

• Recognition in Canadian fintech media

Some people may worry that Neo is “not a real bank,” but this neobank model (fintech + regulated partner) is legitimate and increasingly common around the world.

⸻

- Is the Neo App Safe to Use?

Neo Financial incorporates strong security features to protect user data and funds. It directly addresses the common question: “Is the Neo app safe?”

Key security features include:

• Two-Factor Authentication (2FA): Users must verify logins using both a password and a mobile code.

• Encryption: All sensitive data between the app and servers is encrypted.

• Data Protection Compliance: Neo follows Canadian privacy laws and data protection best practices.

In terms of money safety — funds in Neo Money accounts are held with Concentra Bank, a CDIC member. So even if Neo were to go offline, your money is protected by CDIC up to $100,000.

The app also gives users control features like instant card lock, real-time transaction alerts, and easy fraud reporting. Overall, the Neo app takes user safety seriously and provides tools to back it up.

⸻

- Neo Financial Mastercard – Is It a Good Credit Card?

Whether the Neo Financial Mastercard is a good credit card depends on your spending habits, but it offers strong features for many users.

Neo offers three card tiers:

• Neo Mastercard (Standard)

• Neo World Mastercard

• Neo World Elite Mastercard

Key benefits:

• Cashback Program: Earn an average of 5% cashback at Neo partners, and a guaranteed 0.5% minimum on all other purchases.

• No Annual Fee: Most cards have no annual fee.

• Custom Perks: Premium cards offer tiered rewards and can be customized with bonus subscriptions.

For users who shop regularly at Neo partner stores, this card can lead to serious savings. Its real-time cashback model is simple and rewarding — no confusing points or airline miles.

⸻

📸 Image credit: @neofinancial on Instagram

- What’s the Credit Limit for the Neo Mastercard?

Neo assigns credit limits based on your financial profile, like:

• Credit history

• Income

• Risk level

Typical credit limits can reach up to $10,000, depending on the applicant. Neo also offers a Secured Mastercard, where users can set their own limit (starting at just $50) by providing a deposit. This is a great tool for people building or rebuilding credit.

Neo gives instant approvals and communicates the credit limit clearly through the app interface.

⸻

- Where and How Can You Use the Neo Financial Card?

Short answer: anywhere Mastercard is accepted — which includes almost every major store globally.

Neo cards (both the Mastercard and Neo Money card) work for:

• Online shopping

• In-store tap/swipe/insert

• Bill payments

• International transactions (foreign exchange fees may apply)

Users also get a virtual card instantly after approval, so they can shop online before the physical card arrives. While cashback applies everywhere, higher rewards are unlocked when spending at Neo’s partner retailers.

⸻

📸 Image credit: @neofinancial on Instagram

- Who Owns Neo Financial?

Neo Financial is a privately owned Canadian fintech founded by Andrew Chau, Jeff Adamson, and Kris Read (same guys who founded SkipTheDishes). It’s not owned by a big bank.

Instead, Neo partners with Concentra Bank, a CDIC-insured institution, to hold user funds securely.

The company is also backed by major venture capital firms and continues to expand its presence across Canada.

⸻

- Pros and Cons of Using Neo Financial App

Like any financial product, Neo has both strengths and weaknesses depending on the user.

⸻

Pros of Using Neo Financial App:

• High Cashback Rewards: Average 5% at partner stores

• Modern App UI: Easy to use, sleek interface

• No Monthly Fees: For the Neo Money account

• CDIC Deposit Protection: Through Concentra Bank

• High-Interest Savings: Competitive rates vs traditional banks

• Instant Virtual Card: Shop online instantly after approval

⸻

Cons of Using Neo Financial App:

• No Physical Branches: Entirely online support

• Relatively New: Less established than traditional banks

• Limited Credit Tools: Some users get low initial limits

• Partner-Dependent Cashback: Best rewards tied to partner spending

• Customer Service: Mostly online-based, not in person

⸻

Here is a visual comparison chart summarizing the pros and cons:

| Feature | Pros | Cons |

|---|---|---|

| Cashback | High, instant cashback at partner stores | Best rates limited to Neo partners |

| Fees | No monthly fees, no annual fee options | – |

| Accessibility | Clean UI, instant virtual card, fully digital | No physical branches |

| Security | 2FA, encryption, CDIC deposit protection | – |

| Savings | High-interest savings options available | – |

| Credit Building | Secured Mastercard helps build credit | Lower starting limits for some users |

| Company Age | Modern, fast-growing fintech | Newer than traditional banks |

- Final Verdict: Is Neo Financial Worth Using in 2025?

After a thorough review of the Neo Financial App, its features, security measures, and overall value proposition, the final verdict on whether it is worth using in 2025 largely depends on an individual’s financial habits and preferences.

Neo Financial has successfully carved out a niche in the Canadian fintech landscape by offering a compelling alternative to traditional banking.

For cashback seekers and those who frequently shop at Neo’s extensive network of partner retailers, the Neo Financial Mastercard and its associated rewards program present a significant advantage. The instant cashback model is a powerful incentive, providing tangible savings that can quickly add up.

📸 Image credit: @neofinancial on Instagram

Tech-savvy Canadians who are comfortable with digital-first banking and prefer managing their finances through a mobile app will find Neo’s sleek interface and convenient features highly appealing. The absence of physical branches is a non-issue for this demographic, who value efficiency and accessibility from their smartphones.

Individuals looking for low-fee banking solutions will also find Neo Financial attractive. The Neo Money Everyday account, with its no-monthly-fee structure and competitive high-interest savings rates, offers a cost-effective way to manage daily finances and grow savings.

While Neo Financial isn’t a traditional bank, its partnership with Concentra Bank ensures that eligible deposits are protected by CDIC, addressing a major concern for many users. The robust security features, including two-factor authentication and data encryption, further enhance the app’s safety profile.

In conclusion, Neo Financial is a legitimate, safe, and highly usable financial tool for a significant segment of the Canadian population. It excels in offering rewarding cashback programs, a user-friendly digital experience, and low-cost banking. While it may not be the ideal fit for those who prefer in-person banking or require extensive credit-building tools beyond its Secured Mastercard, for the modern Canadian consumer seeking an innovative and rewarding financial solution, Neo Financial is undoubtedly worth considering in 2025.

⸻

FAQ

To further assist our readers and enhance the article’s visibility in search engine results, here are answers to some frequently asked questions about Neo Financial:

Is Neo Financial legit?

Yes, Neo Financial is a legitimate Canadian fintech company. While it operates as a neobank, it partners with regulated financial institutions like Concentra Bank, a CDIC member, to offer its banking products. This ensures that eligible deposits are protected by CDIC insurance.

Is my money safe with Neo Financial?

Yes, your money is safe with Neo Financial. Funds held in Neo Money accounts are held with Concentra Bank, a CDIC member institution. This means eligible deposits are protected by CDIC up to $100,000 per insured category, per depositor.

What is the credit limit for the Neo Mastercard?

The credit limit for the Neo Mastercard can vary based on your creditworthiness, with limits potentially going up to $10,000 for the standard card. Neo also offers a Secured Mastercard where the credit limit is determined by your security deposit, starting from as little as $50.

What bank owns Neo Financial?

Neo Financial is a privately owned Canadian fintech company, co-founded by Andrew Chau, Jeff Adamson, and Kris Read. It is not owned by a traditional bank. However, it partners with Concentra Bank, a CDIC member, to hold user funds for its banking products.

Can I use Neo Financial outside Canada?

Yes, as the Neo Financial Mastercard operates on the Mastercard network, it can be used for transactions outside of Canada wherever Mastercard is accepted. However, foreign exchange fees may apply to international transactions.

⸻

Ready to experience a modern approach to banking?

“Tap into smarter banking — download the Neo Financial app today from the App Store or Google Play.”

💬 Have questions or feedback? Drop your thoughts in the comments — we’d love to hear from you!

References

📚 References

- Neo Financial – Official Website

- Concentra Bank – CDIC-Insured Partner

- Canada Deposit Insurance Corporation (CDIC)

- Mastercard – Global Acceptance Info

- Government of Canada – Financial Consumer Agency

- Neo Financial – Security & Privacy

- Neo Financial – Rewards & Cashback Program

- Neo Financial Mastercard Info